Without a KYC, you can’t access any pay later apps. Several online apps are available in India that offer the option to pay later, however, without a Pan card, you will not be able to use them. Is There Any Pay Later Apps Without Pan Card in India? With no foreign markup fee, the Slice card can save you money on international transactions like buying a domain or course outside India.

#Best buy now pay later apps 2021 free#

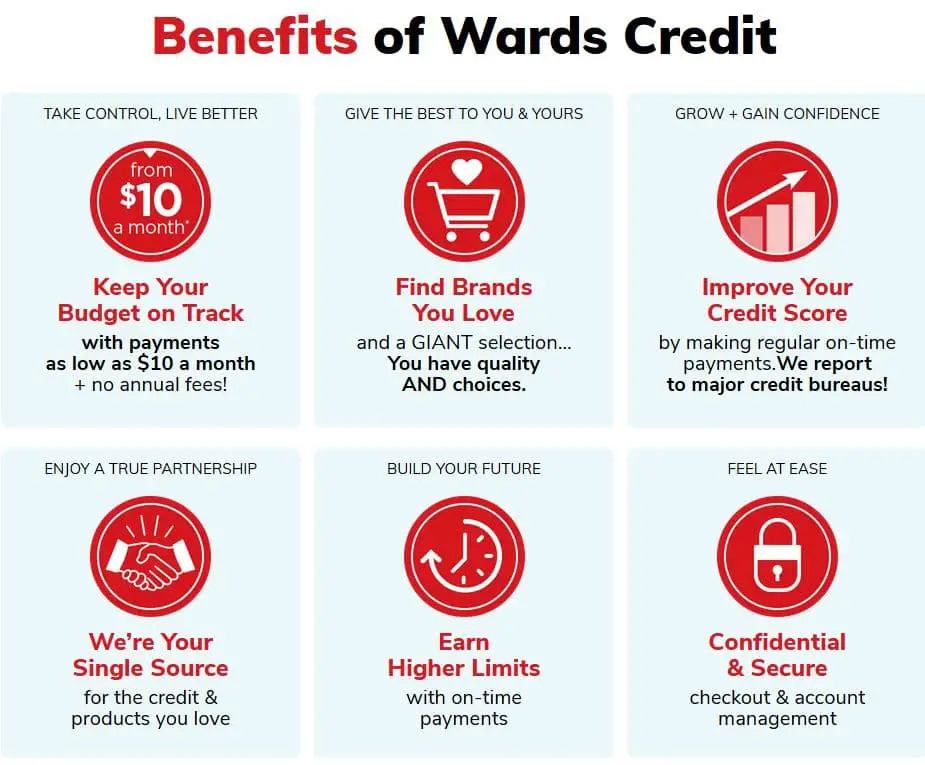

It’s also free (No joining, No annual fee). So, If you are a student and don’t have a credit score, get a Slice card because timely payments will help you build one. Moreover, You get 1-2% cash back when you use a slice card on top of the Spark Discounts. Slice also offers a feature called “Sparks” using which you can get up to 30-50% cashback from Myntra, Flipkart, and IRCTC. But if you pay your Slice credit card bill in more than 3 EMIs, you’ll have to pay 12-15 percent interest. Moreover, Slice lets you pay in 3 EMIs without any fees. However, You should avoid Slice if you already have credit cards because it’s a prepaid card with a line of credit. That’s why, Slice has a good market position among people without credit, like students or housewives. After getting a slice card, you can easily build your credit score with regular use and timely payments. If you’re a student without a CIBIL score, the Slice credit card is a good option because it doesn’t require one. The bill is generated every 15 days, and there are no additional charges.īest Pay Later Apps For Students 2023– SliceĪre you are looking for the best buy now pay later for students? then the slice is the best option for you. The application should include its customers’ many discounts and offers which can get used to save money. This pay later service by Ola has accepted over 300+ apps. The customers can use this service for postpaid to pay for Ola Cabs. The application can be accessed via the iMobile app, ICICI Pockets, and net banking. Pay Later by ICICI Bank provides up to a 45-day credit duration. The customers can pay bills, make payments to merchants using a UPI ID, and do shopping. The Pay Later by ICICI Bank is only for eligible existing ICICI Bank customers. However, the customers have to pay a one-time activation fee of ₹99. In addition, Mobikwik gives 15 days of Interest-free credit, and customers get up to ₹30,000 limits. You can pay later to pay bills and on brands associated with the Mobikwik application. The app gives a usage fee of Rs 10 on bill amounts greater than ₹1,000. The Flipkart pay later is provided in partnership with IDFC First Bank. The app gives up to 35-days of free credit and a maximum limit of up to ₹70,000.

The Flipkart pay later can get used to shopping on Flipkart. Freecharge Pay Later annual fee is charged by Axis bank, the amount of ₹199 k. With Freecharge pay, later interest is levied on the amount used. The application gives its customers a monthly billing cycle. The users can use it for payments on Freecharge or other merchants.

It may get used to making direct payments on websites such as Zomato, Dunzo, Rapido, Gaana, BigBasket, 1MG, and others.

#Best buy now pay later apps 2021 android#

Simpl is another Android and iPhone app that allows you to buy now pay later India facility with a single swipe.

0 kommentar(er)

0 kommentar(er)